By Ntombi Mhlongo

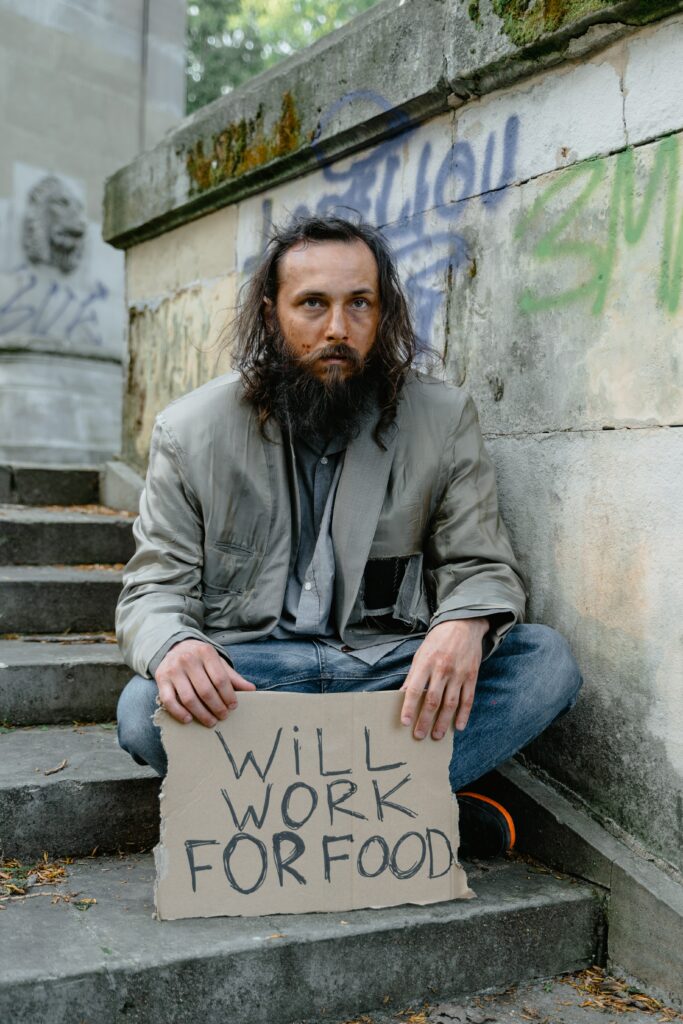

The negative impact of persistent poverty, food insecurity on growth, conflicts, and high debt are anticipated to keep the pace of recovery subdued in most countries in sub-Saharan Africa.

This is a projection that has been made by the World Bank in its Global Economic Prospects for January 2023.

The regional highlights of the report state that even as the cost-of-living pressures are anticipated to moderate, the negative impact of persistent poverty and food insecurity on growth, amplified by other vulnerabilities, such as unfavourable weather, high debt, policy uncertainty, and violence and conflict are anticipated to keep the pace of recoveries subdued in many countries.

It is highlighted in the report that growth in Sub-Saharan Africa softened markedly last year to 3.4 per cent as sharp cost-of-living increases together with weak external demand and tighter global financial conditions tempered post-pandemic recoveries in many countries.

Food prices increasing amid high levels of poverty

Food price pressures, already significant even before the pandemic, have intensified further because of adverse weather shocks, supply disruptions worsened by Russia’s invasion of Ukraine, increased fragility and insecurity, and, in some countries, large currency depreciations.

“Annual food price inflation exceeded 20 per cent in over a quarter of all countries last year, dampening growth in real income and consumer demand, and deepening food insecurity. A substantial deceleration in global growth and falling non-energy commodity prices have weighed on economic activity across SSA, particularly in metal exporters,” reads part of the report.

Read More: Gates Foundation pumps E119bn more into Africa

It mentioned that despite a recent easing of global food and energy prices, import costs remained elevated, contributing to widening current account deficits.

Pandemic-induced weakness in fiscal positions lingered, with the government debt surpassing 60 per cent of GDP in almost half of the SSA economies last year.

Also highlighted in the report is that debt sustainability deteriorated further in many non-oil-producing countries, leading to rising borrowing costs, capital outflows, and credit rating downgrades. Growth in the three largest economies—Angola, Nigeria, and South Africa—pulled back sharply to 2.6 per cent in 2022.

South Africa—the region’s second-largest economy—grew by only 1.9 per cent as electricity shortages worsened and policy tightening accelerated to curb inflation.

Policy uncertainty, flagging external demand, and disruption due to floods and strikes weighed on growth. High oil prices and stable oil production supported a 3.1 per cent rebound in Angola.

Economic growth and recovery to be subdued

Meanwhile, the report mentioned that growth in Nigeria—SSA’s largest oil producer—continued to weaken as production challenges in the oil sector intensified.

In terms of the outlook, it is projected that growth in SSA is expected at 3.6 per cent in 2023 and 3.9 per cent in 2024.

“Compared to the June forecast, growth was revised down for almost 60 per cent of countries, including downward revisions for over 70 per cent of metal exporters which are expected to be affected by the further easing of global metal prices.

Even as the cost of living pressures are anticipated to moderate, the negative impact of persistent poverty and food insecurity on growth, amplified by other vulnerabilities, such as unfavourable weather, high debt, policy uncertainty, and violence and conflict is anticipated to keep the pace of recoveries subdued in many countries”.

Read More: New National Development Plan for country’s economic growth

This growth slowdown, the World Bank said, represents a formidable challenge for economic development in the region. Per capita incomes are expected to increase by only 1.2 per cent on average in 2023-24—a much slower rate compared to what is needed to sustain progress in poverty reduction and reverse income losses suffered because of the pandemic.

This year, incomes per capita are forecast to remain more than one per cent lower than in 2019.

Income per capita for countries expected to be low

“Even by the end of 2024, per capita incomes in almost 40 per cent of countries, including SSA’s three largest economies, are expected to be below their pre-pandemic levels”.

In terms of risks, the report says the outlook is subject to many downside risks. A deeper-than-anticipated slowdown of the global economy could cause sharp declines in global commodity prices dampening growth in exporters of oil and industrial metals.

Global financial conditions could tighten more if global inflation pressures persist longer than expected leading to higher borrowing costs and a higher risk of debt distress in many economies.

It said the sub-Saharan food systems, already stressed by elevated costs of farming inputs and weather-induced production losses, remain particularly vulnerable to further disruptions that could lead to surging food prices and increased food insecurity.

“High levels of violence and conflict could escalate further if living standards continue to deteriorate. This together with increased frequency and severity of climate change-induced weather shocks could further disrupt agriculture and delay large infrastructure and mining projects in some countries,” it was highlighted in the report.