By Ntombi Mhlongo

Experts and those who previously worked in local government are of the view that the proposed plan to stop municipalities from taking bank loans will affect service delivery. It has been reported that government, through the Ministry of Finance currently headed by Neal Rijkenberg, wants to operationalise a section of the Public Finance Management Act of 2017 which will prevent local governments from borrowing money from financial institutions, as is currently the case. Instead, the local governments will only borrow from the government.

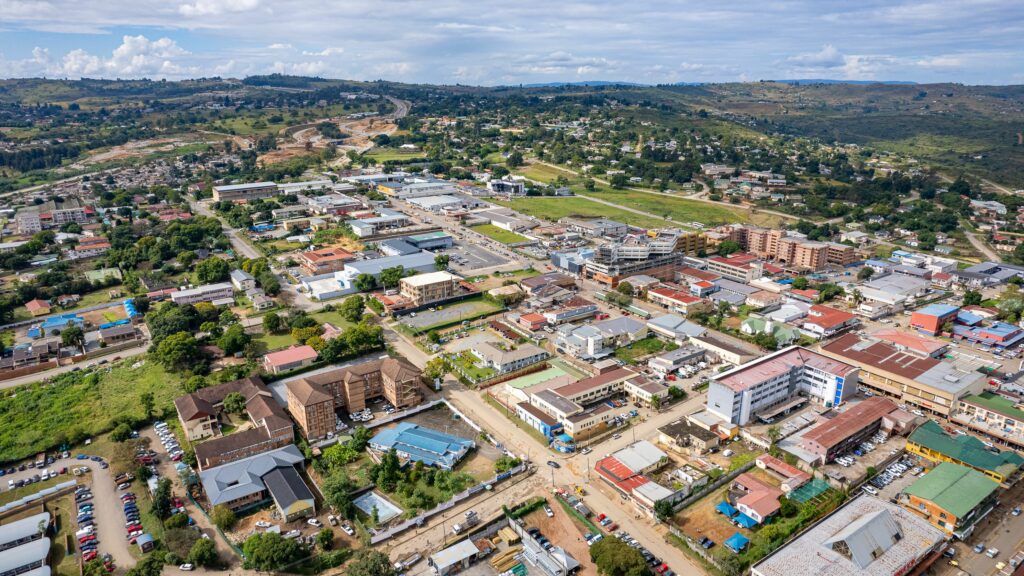

The experts said if the policy is eventually approved and implemented, it will have a negative effect on the local governments as they might struggle to deliver on their mandate which is ensuring that proper infrastructure is made available and maintained in the towns, the towns are kept clean at all times, streets lights are kept lit at night to maintain a safe environment and well-being of the residents, visitors and businesses.

A former mayor in one of the local municipalities said this would be a bad decision by the government.

“I sense that there will be resistance from the councils purely because the government does not have money. The government itself is failing when it comes to its own projects related to infrastructure due to a lack of resources hence municipalities take the initiative to take service loans at banks. The good thing is that the municipalities did not just go to the banks on their own but sat down with the minister responsible, outlined the projects they want to embark on and the government would agree to provide a surety. There have not been problems at all,” he said.

Elaborating, the former mayor said taking such a decision would take the country back as municipalities contributed a lot in terms of infrastructure development in the towns which allowed the government to then focus on the communities and rural areas.

“The municipalities will be depressed if they will be allowed to borrow only from the government. There is just no need for such a regulation especially because the municipalities do not have a challenge servicing the loans they take from banks,” he said.

According to the experts, most of the local governments in the country are already suffering due to non-payment of rates which makes it hard for them to implement their planned projects and offer the best in terms of service delivery.

“When they struggle to collect enough revenue, they find themselves with no choice but to engage financial institutions and borrow money to implement the projects,” one of the experts said.

It should be noted that Auditor General Timothy Simelane’s Compliance Audit Report for the month ended 31 March 2021 revealed that municipalities are failing to collect revenue from consumers with five of them owed around E50 million.

In the report, the AG highlighted that the non-payment of rates impacts service delivery, in the sense that the organisation is unable to implement planned projects and programmes on time.

Secondly, the AG said non-payment of rates causes an unhealthy cashflow, thereby leading to supplier payments default and litigation

Meanwhile, another expert said, “Every local government needs money to fulfil the growing public demand for services of the town which include more recreation facilities, youth empowerment programmes, construction of good roads and improvement of stormwater drainage and also the upkeep of infrastructure which includes roads, streetlights and waste services amongst others. Banks loans come in handy. Also, the banks are better because they give out the full amount of the loan while the government might release the money in bits and pieces which delays the projects.”

A councillor said while the government might have good intentions, the proposed plan will not work since the regulation that will enforce it will specify that the municipalities can only borrow from the government.

“The government itself is usually the main culprit when it comes to debts owed to local governments. You cannot then expect the local municipalities to rely on that same government for loans,” the councillor said.

When compared with neighbouring countries, the Republic of South Africa has in place what is known as a Policy Framework for Municipal Borrowing and Financial Emergencies.

The principles of the policy framework include that creditworthy municipalities should borrow responsibly to finance capital investment and fulfil their constitutional responsibilities.

It also highlights that municipal access to private capital, based on investors’ evaluation of municipal creditworthiness, is a key to efficient local government and fiscal discipline and that municipalities should borrow in the context of long-term financial strategies, which reflect clear priorities and the useful life of assets.