BY SIFISO SIBANDZE

Although Eswatini is one of the smallest countries in Africa, found in the South-eastern territories of the African continent, this tiny Kingdom, nestled between South Africa and Mozambique presents investment potential far larger than what initially appears. Eswatini is a gateway to an impressive regional market of about 1.2 billion people in all the 55 African countries by being part of the African Continental Free Trade Area (AfCFTA). In addition to these countries, Eswatini has access to preferential markets including the European Union, the United States and Taiwan.

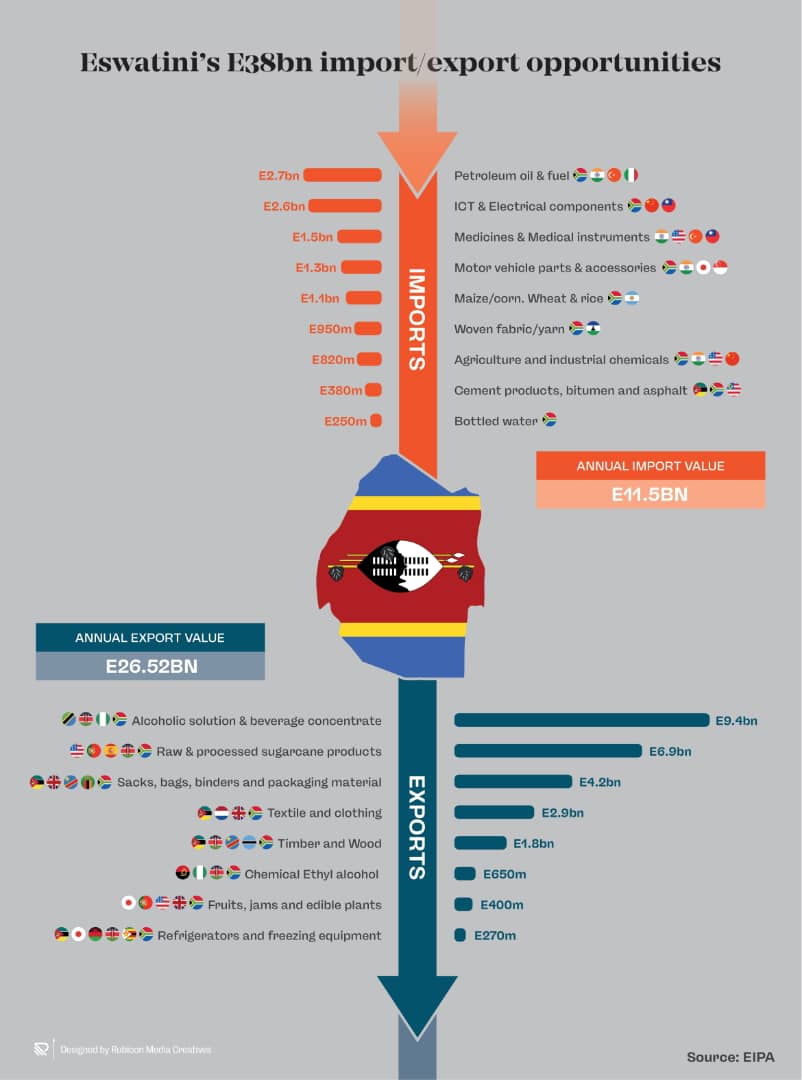

Statistics sourced from Eswatini Investment Promotion Authority (EIPA) reveal that the country boasts over E38 billion in both import and export opportunities in a variety of sectors. On the imports side, the business opportunities are in the sectors wherein emaSwati are still falling-short of producing enough volumes of the goods to satisfy the local market and as a result, this vacuum is filled by imports from the region and globally.

Information sourced from Eswatini Investment Promotion Authority (EIPA), Eswatini is open for either local or foreign investors who could invest in petroleum oil and fuel, ICT and electrical components production, production of medicines and medical instruments, motor vehicle parts and accessories, woven fabric/yarn, maize/corn, agriculture and industrial chemicals, cement products and bottled water.

For all these mentioned products, Eswatini is spending over E11 billion per year to import. In juxtaposition, the Kingdom can realise numerous benefits if the exported money could be reinvested in the country.

EIPA Chief Executive Officer, Sibani Mngomezulu said these are the business areas or sectors that are open for investors, whether local or foreign. The CEO decried the exorbitant sum of money that Eswatini is spending to import goods that could be produced in the country.

Mngomezulu said luring investors to invest in the country could boost the economy through the creation of jobs and increased foreign exchange.

On the export opportunities, Mngomezulu said Eswatini is ready to welcome foreign investors looking at investing in the production of, among others, sacks, bags and packaging material, fruits and jam, wood and timber and refrigerator and freezing equipment.

Currently, Eswatini is exporting various goods to the region and global markets above E26 billion, but according to Mngomezulu, this is a far cry from what the market demands, hence a strong need for more investors who can come to set up shop so that the country can increase the export volumes required by the market.

Mngomezulu told Eswatini Financial Times that EIPA is continuously engaging with prospective investors who can invest in the production of refrigerators and freezing equipment, textile and clothing, raw and processed sugarcane products and alcoholic solution and beverages concentrate.

According to Mngomezulu, Eswatini offers numerous advantages for foreign direct investment. Over the years, the Government of the Kingdom of Eswatini has introduced highly supportive initiatives to simplify procedures and remove some red tape in establishing and running venture capital companies and private equity companies in a form of a one-stop shop.