By Bahle Gama

The reports of the Rand grappling to stay afloat have been circulating regionally and globally causing panic in several markets. The Lilangeni is pegged with the Rand at parity and is still widely accepted as a substitute. Therefore, whatever happens to the Rand affects the Lilangeni, the good and bad, in weakness and in strength.

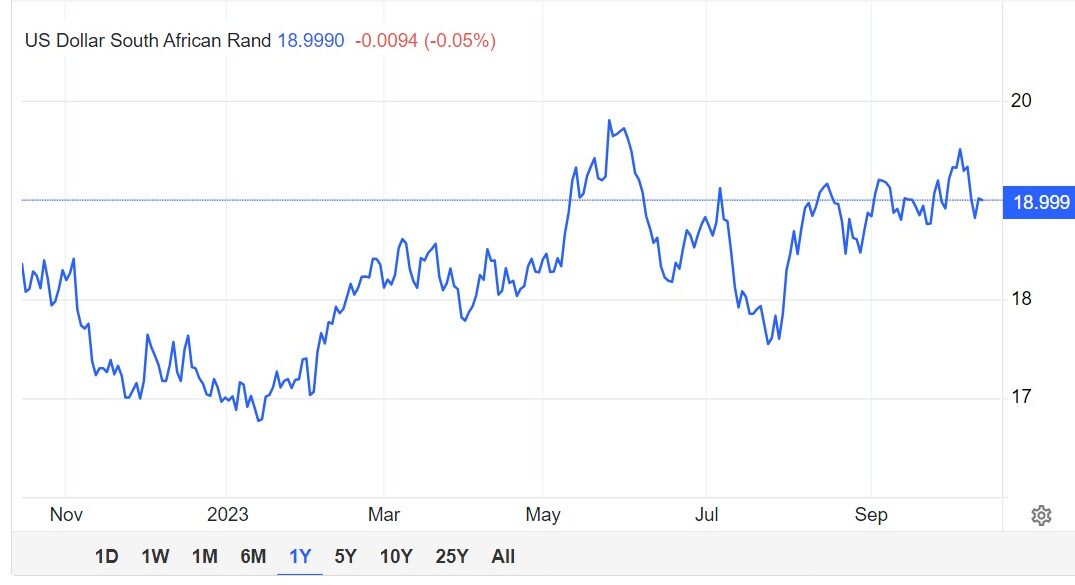

The entire year the Rand has reportedly been through a ‘rollercoaster’, from bleeding to being on life support causing panic and scepticism to many including international investors. On Friday, October 13, Trading Economics reported that the Rand was found to be trading at E18.90/US$1 at 2p.m. The weakening of the Rand according to Economist Thembinkosi Dube is likely to affect foreign public debt because of the exchange rate.

ALSO READ: Maloma Colliery: Building Prosperous Communities Supplement

“In terms of the local debt we are talking about sale treasury bonds which are not affected compared to foreign debt affected by the exchange rate,” he said. The Economist made an example that when the country makes a debt of E100 million from other countries, the government makes this debt in local banks.

However, when paying the money, the effect will be felt through the exchange rate of the borrowed money, not the instalment.

He said if for example, the agreement was that in six months an installment of E5 million will be made by Eswatini, when the currency weakens against the US$1 as is the case, the country would find itself paying more, about E7.5 million at most. “The agreement has not changed, just the exchange rate and no one is in the wrong per se, just the state of the Lilangeni against the dollar at the time, because to the foreign country we have to pay same as per the agreement, but to us it’s a lot” he clarified.

Dube noted that the Central Bank of Eswatini is doing everything possible to hedge against that. Dube was echoed by UNESWA Lecturer and economist Sanele Sibiya who said that the weakening of the Rand means Eswatini will need more of the Lilangeni to pay its debt in dollars. “We pay our debt with the foreign currency so when the Rand weakens it means that we need more of our currency to pay. It therefore looks like the public debt has increased because the exchange rate requires more money from our side to pay,” he said.

. . . WEAKENED LILANGENI MAKES INTERNATIONAL IMPORTS EXPENSIVE

Economist Sanele Sibiya said that when the Rand/Lilangeni is weakened, it makes international imports more expensive whilst making exports more competitive in the global market. Essentially what this means is that the sales of Eswatini products will increase on a worldwide scale. However, Sibiya noted that since Eswatini imports most of its input products, the increase in the worldwide scale could be short-lived because they are imported into the country thus being costly.

He said given that Eswatini and South Africa operate within a flexible exchange rate regime, the value of the Rand/Lilangeni like any commodity is determined by the market forces of supply and demand. “The demand for a currency relative to the supply will determine its value in relation to another currency.

Theoretically, the demand for a floating currency and hence its value changes continually based on a multitude of factors. In the case of the rand, its current weakness can be attributed to a myriad of structural problems facing the local economy,” he said.

The Economist said that in terms of imports, Eswatini will be cushioned as 50 per cent of the Kingdom’s imports are from South Africa. According to Sibiya, the main determinants of a currency’s value include the demand for a country’s goods and services which is closely linked to the growth and national income of its main trading partners.

Equally important is the domestic interest rate. If it is high, it is likely to attract foreign capital, causing the exchange rate to strengthen. However high inflation can wipe out the benefit of high interest rates to foreign investors. According to Statista, factors that serve to drive a currency down include a current account deficit. The current account deficit gets bigger when a country spends more on foreign trade than it is earning and has to borrow capital from foreign sources to make up the difference.

ALSO READ: South Africa’s economy expected to improve into 2024

This implies that a country requires more foreign currency than it is getting through sales of exports, and it supplies more of its own currency than foreigners demand for its products. This excess demand for foreign currency leads to depreciation in the value of a currency. Factors such as political instability and poor economic performance can reduce investor confidence. This inevitably forces foreign investors to seek out stable countries with strong economic performance.

Thus, a country that is perceived to have positive attributes will attract investment away from countries perceived to have more political and economic risk.

“There is a further complication to currency movements. The buying and selling of currencies is no longer driven only by the need to facilitate trade but also by the demand for currencies as financial assets.” This means that currencies are bought and sold like any other asset. Decisions by traders to buy or sell a currency can have a marked effect.

. . . ‘ LOW-INTEREST RATES, HIGH INFLATION DISINCENTIVIZING INVESTORS’

Investec Chief Economist Annabel Bishop says comparatively low-interest rates in SA and high inflation have reduced real returns thus disincentivising investors.

Bishop said the slower pace of rate hikes compared to the United States has reduced the risk premium offered to investors. “The high-risk nature of SA as an investment destination means interest rates must be higher in SA than in the US.

Lowering the difference between SA and US interest rates simply weakens the rand, in turn placing upward pressure on inflation,” Bishop explained. In the first week of October rating agencies flagged South Africa’s low growth potential as a key credit weakness. One of these was S&P Global which reportedly unexpectedly downgraded the neighbouring country’s credit outlook from positive to stable, citing the economic impact of load-shedding.

The agency said worsening economic conditions mean that South Africa’s efforts to claw back its investment grade ratings will be more arduous. According to S&P, another reason for the rand’s weakness in the dollar strength which was recently bolstered by hints that interest rates in the US would peak at a higher level than previously expected. “Higher interest rates mean higher yields for investors, thus attracting foreign capital. As the demand for the dollar increases, its value goes up,” said the agency. In 2022, the two-year treasury yields reportedly rose above 5 per cent for the first time since 2007.