By Staff Writers

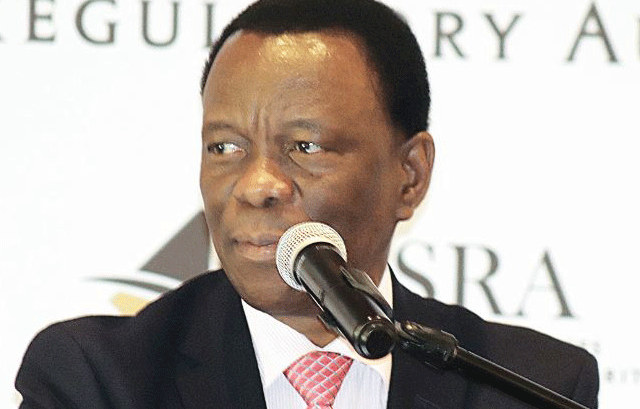

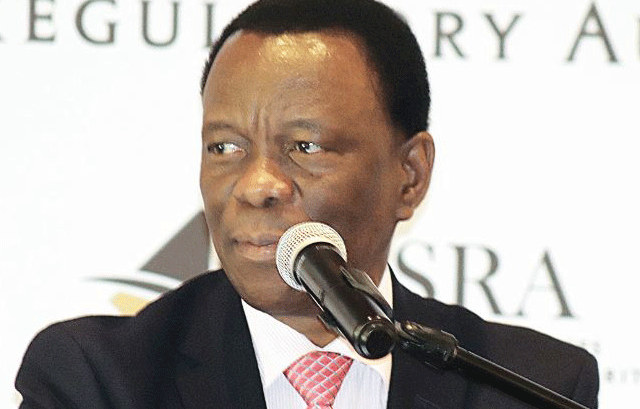

Former Financial Services Regulatory Authority (FSRA) CEO Sandile Chief Dlamini has been fingered as having links to a group of South African looters who have swindled emaSwati out of millions.

Investigations by the Eswatini Financial Times have lifted the lid and exposed that Dlamini is currently involved with a company that David “Dave” Van Niekerk is a former director of in South Africa. Dlamini’s relationship with the companies has left much to be desired despite vehemently denying any sort of links, industry players said his dealings smack of corruption, at the very least. Dlamini says his hands are clean in the matter involving Ecsponent and Status Capital Building Society.

This comes after an article carried out by this publication last week stating that the directors of Status Capital and Ecsponent are the same. Eswatini Financial Times gathered that Status Capital Building Society, which was in the headlines following the disappearance of its E82 million is run by the same people who siphoned E340 million from Ecsponent investors.

According to company registration records filed with the Registrar of Companies which Eswatini Financial Times has seen, one of the founders of Ecsponent Eswatini Limited was Van Niekerk, the very same person who is a Director at Status Capital Building Society. Most recently, Van Niekerk was named in court papers in the matter between Status Capital and Swaziland Debt Factoring Firm. It was submitted that on July 1, 2020, in Ezulwini, Status Capital, represented by Van Niekerk who is popularly known as DVN and Claude Scholtz, in their official capacities, entered into a written debentures agreement with Marthinus Prinsloo, who represented the Swaziland Debt Factoring Firm, for an investment amount of E67 293 700.

The money was to be invested in the financial services company. However, the amount was said to be now over E82 million because of arrears. Despite demand, Swaziland Debt Factoring Firm refused to make a payment or cede the security as provided for in the debentures agreement and cession agreement. In terms of the agreement, Swaziland Debt Factoring Firm became the issuer, while Status Capital was the investor. The intention was that the two entities form a lending partnership.

Allegations are that over E82 million invested through Status Capital Building Society was diverted out of the country without authorisation, by Swaziland Debt Factoring Firm. Status Capital was granted an interim order interdicting and restraining Swaziland Debt Financing Firm from transacting, making and transferring any payment from its bank accounts held with First National Bank (FNB). Van Niekerk was the Chief Executive Officer at MyBucks, the company in which the Ecsponent money was invested. He was also one of the founders of Ecsponent.

Many people said Dlamini as the former CEO who granted licences to the same people should be held accountable. Compounding Dlamini’s troubles, his former employer, the FSRA issued a public warning on November 28, cautioning the public that he and Nomusa Ndlovu were “promoting services of Aluma Capital (PTY) Limited as an investment advisor without authorisation from the FSRA.”

Investigations have revealed that Van Niekerk is a former director of Aluma Capital which Dlamini is now representing in the country. This also follows revelations that shortly after he departed from FSRA, Dlamini became a board member at Status Capital, suggesting he had a certain relationship with the directors. He has denied this.

The company is registered in South Africa under the Companies and Intellectual Properties Commission (CIPC). A search conducted on the company has also uncovered a litany of directorial changes, some as recent as December 14, 2022. The CIPC is the South African equal of the local Registrar of Companies. The files of the company in the CIPC show that van Niekerk joined the company as a director in 2015 and resigned as a director on September 9, 2022.

The CIPC linked van Niekerk to more than 30 other companies including Blue Financial Services and VSS Financial Services as a director or former director. Dlamini this week said if people thought he specially treated the directors, or his hands were not clean, they were free to share the information they had on him with either the Anti-Corruption Commission or the Royal Eswatini Police Service Fraud Unit.

Dlamini said if there was any wrongdoing he did, he must be held accountable for it. He said these two entities were also free to investigate him and if he was found to have done anything wrong, they could arrest him and take him to court. Dlamini said his bank accounts were open to investigations using the relevant laws, including the Money Laundering and Terrorism Financing (Prevention) Act of 2016 and they could investigate all monies which have ever been deposited into his accounts and his assets could also be checked to see what he got in return for any corruption he was involved in. Dlamini said it would be possible to investigate if he had diverted any of his money to accounts outside the country.

“If my hands were not clean, what does it mean about the people I left at FSRA who renewed the licences of these entities? Was it still Sandile who said they should renew those licences since I had too much influence,” he said.

Dlamini added that he left the FSRA in 2019 and the licences were renewed in 2020, 2021, and 2022. He said FSRA would be in a better position to respond to some of these questions. When asked about his relationship with the directors of the two entities, Dlamini said when he left FSRA, there was no clause in his contract preventing him from working in the financial industry.

He said he was appointed as a board member at Status Capital and hardly three months after, he got employment in another company, and he resigned. He said he then decided to stop working in the industry. He added that during the three months, of December, January, and February, there was never a board meeting as the company was still being set up.

Dlamini said none of the directors of the two companies was his friend. He said he was a free person and talked to everyone who wished to talk with him. Dlamini said he did this in a public place, and they discussed many issues including those about soccer, the industry, and the church. He said others seek advice from him on how to do some things. He said he was acquainted with many people, but only a few with his friends.

“I am a public person and I make sure that I meet people in public to make sure people do not think we are plotting anything,” Dlamini said.

When asked where he thought things went wrong, leading to emaSwati losing their money, Dlamini said he was not in the right position to discuss that as he did not know some facts.

“I don’t think I am competent to comment on this issue,” he said. Dlamini said the role of a regulator was to look at the legislation and implement it. He made it clear that he was not speaking on behalf of the FSRA in this issue, but as a former employee who has worked under the legislation. He said if the people satisfy the minimum requirements in the legislation, they are granted a licence. He said the regulator did not have any power to check how the people then work or who had the capacity and resources to check on the day-to-day activities of the companies. He said regulation was not about supervision, but about implementing regulations which were passed in Parliament.

Dlamini said the regulator could only act within the boundaries of the statute. He added that the same fate which occurred to Ecsponent investors also happened in other countries including Botswana and South Africa where there was the Johannesburg Stock Exchange which had enough resources to deal with such issues. He said the same people who siphoned money from emaSwati did the same in those countries. Efforts to get a comment from the FSRA on giving the former directors of Ecsponent a licence to run Status Building Society proved futile. A questionnaire sent on December 7 has still not been responded to. The FSRA acknowledge receipt of the questionnaire and said they would respond by Friday, December 9 after all internal processes have been completed.

However, responses were not forthcoming on the day, and on Monday, a follow-up email on the questionnaire was made but no response was obtained.