By Ncaba Ntshakala

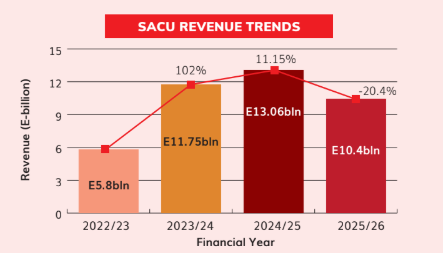

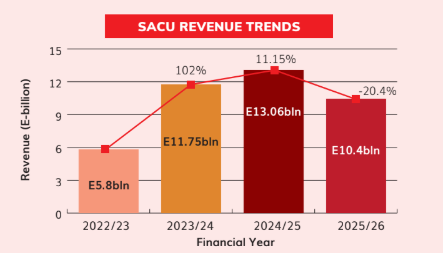

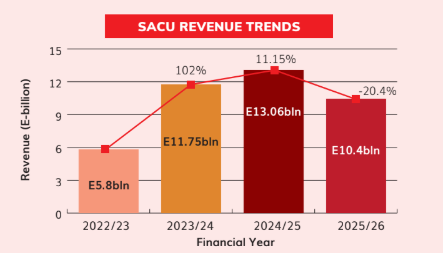

The Kingdom of Eswatini has experienced a significant decline in Southern African Customs Union (SACU) revenue for the 2025/26 fiscal year, marking a 20.4 per cent reduction compared to the current fiscal year.

Minister of Finance Neal Rijkenberg announced that the country would receive E10.4 billion in SACU receipts, representing a sharp E2.66 billion decline from the E13.06 billion received in 2024/25.

This reduction in SACU revenue is primarily attributed to under-collections in the Common Revenue Pool (CRP) during the 2023/24 fiscal year.

Minister Rijkenberg explained, “This under-collection was driven by a contraction in nominal imports into the Union and reduced revenues from specific excise duties, particularly on cigarettes and tobacco products.”

RELATED: Declaring your goods at the border helps Eswatini with its SACU receipts

The volatility in SACU revenues, which has been a persistent challenge, is expected to continue in the medium term due to fluctuations in collections.

The announcement comes as a turning point following three consecutive years of significant growth in SACU receipts. In 2022/23, Eswatini received E5.8 billion, surging 102 per cent to E11.75 billion in 2023/24.

The upward trajectory continued into the 2024/25 fiscal year, with receipts increasing by an additional 11.15 per cent to reach E13.06 billion. However, the projected decline for 2025/26 signals a reversal of this trend.

In light of this volatility, the government has taken proactive steps to stabilize the fiscus. The Minister highlighted the establishment of the Revenue Stabilization Fund in 2023, following its regulatory approval by Parliament.

The fund, which currently holds a balance of E2.47 billion, will be crucial in cushioning the nation’s finances against the anticipated shortfall. “Some of this will be used in the 2025/26 budget to maintain the stability of the fiscal,” the Minister said.

Despite the challenges, Minister Rijkenberg emphasised the government’s commitment to fiscal stability. “The Revenue Stabilization Fund is designed to cushion the nation’s finances against such fluctuations, ensuring that we can maintain fiscal stability,” he stated.

SACU, which includes Botswana, Lesotho, Namibia, South Africa, and Eswatini, operates under a revenue-sharing model where trade taxes collected in the common customs area are distributed among member states.

Eswatini recently received its final tranche of E3.2 billion for the current fiscal year, which the Minister confirmed will be allocated to the national budget as planned.

RELATED: IMF urges fiscal restraint as future SACU revenues decline

SACU Revenue trends in the past four years:

2025/26 FY: E10.4 billion (20.4% decline)

2022/23 FY: E5.8 billion

2023/24 FY: E11.75 billion (102% growth)

2024/25 FY: E13.06 billion (11.15% growth)