by Ncaba Ntshakala

The Central Bank of Eswatini’s Annual Economic Review for 2023 revealed a significant surge in the country’s import bill for services, amounting to a record E9.067 billion.

This shows a considerable rise, driven by substantial growth in various service sectors, particularly in professional and management consulting services, financial services, and intellectual property rights.

A closer look at the data highlights that ‘other business services’ which includes professional, management consulting, technical, and trade-related services dominated the outflows, with imports reaching a staggering E4.040 billion.

This figure represented a major leap in the service import bill, positioning the business services sector as a significant contributor to the country’s overall service-related expenses.

RELATED:87% of Financial Inclusion has been a result of all mobile money banking services.

In addition to the notable increase in business services, Eswatini also experienced expanded financial outflows in other sectors.

The financial services industry saw a marked increase in imports, amounting to E360.6 million, while intellectual property-related payments surged to E997.0 million in 2023, reflecting growing demand for international expertise, trademarks, and patents.

Telecommunications imports were also on the rise, totaling E890.6 million, pointing to increased cross-border reliance on communication infrastructure and services.

While many service sectors experienced growth, travel and transport services posted significant contractions. Travel services saw a 13.7 per cent decline compared to 2022, amounting to E698.3 million in 2023, indicating reduced outbound travel expenditures.

Similarly, the country’s transport services outflows fell by a substantial 20.3 per cent, totaling E793.0 million.

This contraction is attributed to the rise in domestic service provision, suggesting that local residents increasingly provided transport services, reducing the need for external providers.

The primary income account recorded a narrower deficit in 2023, decreasing by 7.7 per cent to E5.692 billion, reflecting an overall improvement in the country’s income position.

Improved inflows, which grew by 11.2 per cent to E2.350 billion, played a key role in this development. At the same time, primary income outflows fell to E8.043 billion, a 2.9 per cent decrease, driven by lower dividends paid out, particularly in the investment income sub-account.

Positive inflows from employee compensation also boosted the primary income account.

Net inflows in compensation of employees amounted to E275.7 million, a result of E477.2 million in receipts, which represented a 5.1 per cent increase compared to the previous year.

Meanwhile, payments in this category fell to E201.4 million from E273.7 million in 2022, reflecting a decline in labor-related payments abroad.

Eswatini’s investment account showed promising signs in 2023, with the deficit narrowing to E5.904 billion, down from E6.259 billion in 2022. The improvement was primarily driven by a 20.5 per cent growth in investment income inflows, which reached E1.713 billion.

These inflows, primarily comprising earnings from portfolio investments and interest income, helped to offset the 26.7 per cent decline in investment outflows, which amounted to E5.127 billion.

RELATED:NEDBANK group interim financial results are out today.

The significant drop in investment outflows is largely attributed to companies retaining earnings for reinvestment rather than distributing dividends. This trend signals a strategic shift toward longer-term growth, as businesses seek to enhance their reserves and strengthen their capital positions.

One of the standout highlights of the review was the secondary income account, which registered a robust surplus of E10.996 billion in 2023, a dramatic 55.5 per cent increase from the previous year.

The key driver behind this leap was a substantial increase in Southern African Customs Union (SACU) receipts, which amounted to E11.750 billion for the 2023/24 fiscal year—nearly double the E5.821 billion received in 2022/23.

SACU receipts accounted for 81.9 per cent of all inflows in the secondary income account, highlighting the vital role that customs union revenues play in Eswatini’s financial stability.

Outflows, however, also grew significantly, rising by 37.8 per cent to E1.548 billion, driven by increased personal and other transfers, which amounted to E497.2 million and E1.050 billion, respectively.

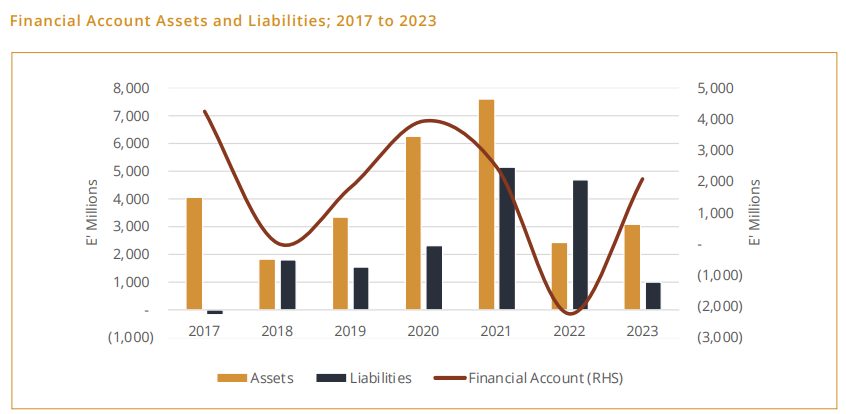

The review stresses that in a marked shift from the previous year, Eswatini’s financial account recorded a net outflow of E2.091 billion in 2023, compared to a net inflow of E2.243 billion in 2022.

The increase in assets, particularly foreign portfolio assets, contributed to this change, with a notable growth in insurance and pension fund investments abroad.

However, the rise in assets was partially offset by a E995.3 million increase in liabilities during the period, reflecting a more complex financial landscape for the country.