By Phephile Motau

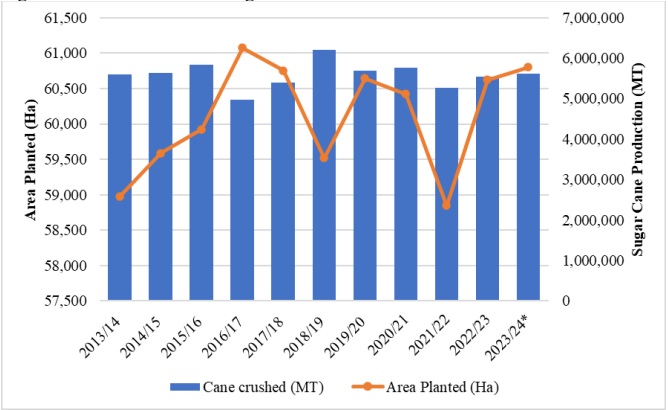

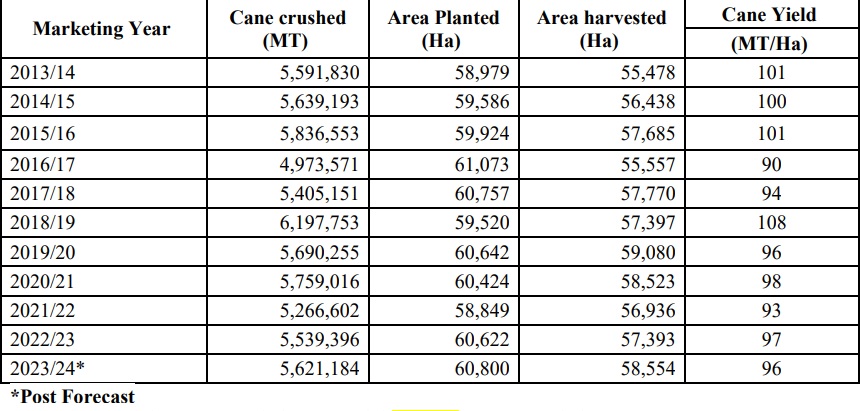

The sugar industry is set for a major recovery with the 2023/24 financial year forecasted to be a recovery period for Eswatini sugar cane production after the 2022/23 season was negatively affected by several factors.

This is according to the Sugar Annual, a report released by the United States Department of Agriculture, Foreign Agricultural Service on April 26. The report was compiled by the Pretoria Post based on reports from the Eswatini Sugar Production and Eswatini Cane Growers Association.

According to the report, late-season heavy rains pushed harvesting into February 2023, well past the normal end of harvest in November. Sucrose content diminishes the longer cane stays on the field past its peak harvest window.

Therefore, cane delivered to the mills in the final stretch of the 2022/23 harvest was lower quality with diminished sucrose content that affected overall recovery rates for the season, according to the report.

Read More: ESA responds to brown sugar concerns

It was further reported that in marketing year (MY) 2022/23, producers also experienced an increased prevalence of yellow leaf aphids, which diminished cane quality. The report state that industry sources indicate that the increased prevalence of the pest is largely due to climate change, which has brought warmer temperatures and greater moisture levels. Another factor hampering cane yield is the cost of fertilizer, which industry sources said is up by about 200 per cent due to supply chain problems since the start of the Russia-Ukraine war.

According to the report, the organisation forecasts area under sugar cane production in Eswatini will increase minimally by 0.2 per cent from 60 622 hectares (ha) in 2022/23 MY to 60 800 ha in 2023/24 MY. Growth in the area is attributed to producers who previously diversified to macadamia returning to sugar cane production.

The report states that industry sources indicate that farmers are slowly moving back to the production of sugar cane due to the industry being well-established along with well-coordinated marketing services provided by the Eswatini Sugar Association.

It was further stated that the estimate for area harvested was revised down to 57 393 ha in MY 2022/23, from the previously forecasted 61 000 ha, due to late-season heavy rains that left fields waterlogged and made it difficult for producers to harvest at all in some areas due to the soggy conditions.

Read More: Ubombo Sugar MD on Energy efficiency, renewables, resilience

It is expected that area harvested will rebound from the 2022/23 MY based on a return to normal weather patterns and a timely harvesting schedule. The report states that the post forecasts sugar cane production in Eswatini will increase by 1.5 per cent to 5.6 million MT in MY 2023/24, up from 5.5 million MT in MY 2022/23.

This is based on increased available irrigation water due to substantial rainfall in MY 2022/23, expanded planted area, and a return to trend yields. Given the high costs of fertiliser, it is likely that producers will use less than ideal amounts in MY 2023/24, which could limit sugarcane yields in some areas. However, on average yields are expected to remain relatively static.

It was further reported that producers faced an increase in electricity costs in MY 2022/23 that increased the cost of production and hampered profit margins as electricity is one of the major production costs for growers given that all sugar cane in Eswatini is produced under irrigation (even though producers do not currently have to pay for water).

The report states that electricity is the second largest production cost for small growers (24 per cent) after harvesting costs (34 per cent).

The department said Eswatini relies on South Africa for about 80 per cent of its electricity supply, but South Africa is currently experiencing significant power generation and supply challenges that could affect the Eswatini sugar industry by pushing production costs even higher, as well as the growers’ fears of a total collapse of the grid.

Read More: Ubombo hires PI to investigate sugar theft

“Currently, scheduled power outages in South Africa do not affect Eswatini due to a contract term between the two countries that prohibits a cut in supply to Eswatini as long as they make timely payments to Eskom, the South African state-owned power operator,” the report states.

It was reported that however, the contract between the two countries will be up for renewal in 2025, which worries Eswatini’s sugar producers, as they fear that new contract terms could lead to the same kind of regular power outages seen in South Africa.

Sugar production to increase by four per cent

The organisation forecasts that sugar production will increase by four per cent to 652,057 MT in the 2023/24 MY, up from 625,361 MT in the 2022/23 MY.

This is based on an expected rebound in the volume of sugar cane deliveries to mills and an improvement in the recovery rate. The sugar recovery rate refers to the number of kilograms (kg) of sugar obtained from a metric ton of sugar cane, expressed as a percentage.

The organisation said the sugar recovery rate is expected to slightly increase to 11.6 per cent in the 2023/24 MY, from 11.3 per cent in the 2022/23 MY based on an expectation of timely cane deliveries to mills in the coming season.

The report states that in 2022/23 MY, millers were affected by a labour strike at one mill that temporarily halted operations (and diminished cane quality due to delayed deliveries and crushing at the mill), as well as late-season heavy rains that waterlogged field and pushed the cane harvest into February, which is three months later than normal, reducing the overall recovery rate for 2022/23 MY.

Read More: EU’s E1.2bn boosts sugarcane farmers’ lives

It was reported that the period for extracting maximum sugar content from cane runs from April to November, meaning that the cane delivered after this period has lower sucrose content. The extended harvest period in MY 2022/23 also left millers with a shorter window (mid-February until the end of March) to perform maintenance and prepare for the 2023/24 MY, which began in April 2023.

This could affect the pace of milling in MY 2023/24 if mills face more frequent shutdowns due to the need for equipment repairs. Sugar consumption in Eswatini remains lower than in other countries

Eswatini’s domestic consumption of sugar is forecast to increase to 73,000 MT in 2023/24 MY, up from 72,000 MT in 2022/23.

The report states that the short-term outlook for Eswatini is positive, with GDP growth projected at approximately three per cent in 2023, compared to just 0.4 per cent in 2022. It was further reported that population growth will also drive up the domestic consumption of sugar.

Annual per capita consumption of sugar in Eswatini is forecasted to increase to 40.2 kg, up from 40 kg in 2022/23 MY, based on population growth, a strengthening national economy, and improved market access in remote areas of the country, which are now serviced by large retail groups such as Shoprite under the Usave brand.

The report states that Eswatini’s sugar consumption remains relatively low compared to other countries, such as South Africa (45 kg) and the United States (68 to 77 kg).

Read More: Focusing on sugar and fruit production cause food insecurity – FAO

Eswatini has always enjoyed strong sugar demand from food and beverage manufacturers who use sugar as one of their main ingredients. Trade sources indicate that the impact of artificial sweeteners on sugar consumption has thus far been insignificant in the country, and the Eswatini sugar industry is not concerned at this stage.

The report states that however, given the increasing trend of using artificial sweeteners in South Africa, in the long run, it is expected that Eswatini manufacturers may also adopt the use of artificial sweeteners to remain competitive in the region.

According to the organisation, the main food and beverage manufacturers that utilize sugar in Eswatini are Bromor Foods, Kraft Foods (previously Cadbury), Ngwane Mills, Parmalat, and Eswatini Fruit Canners – Swazican. Two boutique companies use sugar to produce limited quantities of rum, vodka, and craft gin in Eswatini.

According to the organisation, they forecast that closing stocks will decrease to 51,000 MT in the 2023/24 MY, down from 54,000 MT in the 2022/23 MY, based on forecast increases in exports and domestic consumption. The ESwatini Sugar Association owns the closing stocks of unsold sugar at the end of the season. Stocks held by retailers, wholesalers, and pre-packers are considered sold at the end of the season.

The report further states that large ending stocks of above 40,000 MT pose a challenge to the industry as the Eswatini Sugar Association must pay storage fees for such sugar and compensate millers and growers as all the sugar must be sold at the end of each season.

Sugar exports to increase by 7%

The organisation forecasts that sugar exports will increase by seven per cent to 581 000 MT in the 2023/24 MY, up from 545,000 MT in the 2022/23 MY, based on increased production, the sugar industry’s campaign to increase access in the regional markets, and global demand.

The report states that Eswatini is a member of the Southern African Customs Union (SACU) and exports to Botswana, Lesotho, Namibia, and South Africa duty-free.

Read More: New Ubombo Sugar CEO challenged to find innovative solutions

SACU is said to be the most important market for the Eswatini sugar industry, accounting for 45-70 per cent of the country’s sugar exports, with the majority of exported supplies going to South Africa, the largest economy in the region.

The report states that South Africa is the main market for Eswatini’s raw sugar exports. As of February 2023, Eswatini had exported 256,868 tons of raw sugar to South Africa in 2022/23 MY, accounting for 71 per cent of the country’s total raw sugar exports.

Other African countries to which Eswatini exported raw sugar to in

2022/23 MT include Kenya (two per cent), Botswana (one per cent) and Namibia (0.1 per cent). Eswatini exports its refined sugar mainly to South Africa (51 per cent), Kenya (38 per cent) and Namibia (six per cent).

It was also stated that Eswatini is a beneficiary of the U.S. sugar tariff-rate quota (TRQ), which allows the country to export raw sugar duty-free to the United States. In the 2022/23 MY (as of February), Eswatini exported four per cent of its raw sugar to the United States.

The annual U.S. TRQ allocation for Eswatini is 16,849 MT, which has remained constant over the last several years. The country consistently utilizes its full quota allocation each year, and the organisation expects Eswatini to fully utilize its TRQ allocations in fiscal years 2023 and 2024.

Read More: Sugarcane farmers ‘rescued’ in the nick of time

The report states that the EU had been another large market for Eswatini sugar, but the volume of future raw sugar exports to Europe is uncertain, given the changes in EU domestic sugar policies, mainly, the removal of restrictions for domestic sugar beet production and the end of the preferential prices for sugar imports from least developed countries.

These changes are reported to have resulted in an increase in sugar production in the EU, decreased sugar prices in Europe, and subsequently decreased EU imports from other countries over time.

Eswatini has quota-free and duty-free market access for sugar exports to the EU under the Southern African Development Community-EU Economic Partnership Agreement (SADC-EU EPA). The report states that before the 2018/19 MY, Eswatini enjoyed duty-free access to the East African market based on its membership in the Common Market for Eastern and Southern Africa (COMESA).

However, this privilege was withdrawn due to Eswatini’s membership in the Southern African Development Community (SADC) and Southern African Customs Union (SACU), which do not enjoy duty-free access in COMESA.

According to the report, this resulted in a temporary decline in exports to East Africa in the 2018/19 MY, but exports to the region rebounded in the 2019/20 MY.

The report further states that Eswatini sugar imports are minimal due to the country’s high production volumes, which typically far exceed domestic consumption. Eswatini’s imports are mainly from South Africa and are less than 1 000 MT per marketing year.